HMO Mortgages: A Smart Investor’s Guide to Property Success

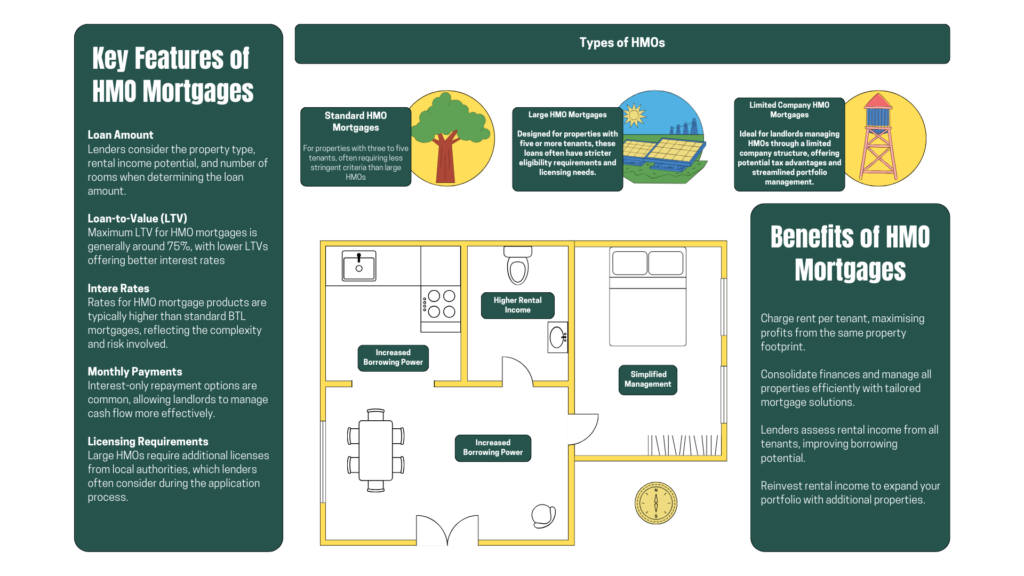

An HMO mortgage is designed for properties where multiple tenants share common facilities such as kitchens or bathrooms. These mortgages are ideal for landlords investing in Houses in Multiple Occupation (HMOs), which often generate higher rental yields than standard buy-to-let properties.

Larger HMOs—those accommodating five or more tenants—may require additional licensing from local authorities. These properties must comply with stringent safety and regulatory standards to ensure tenant well-being.

What Is an HMO Mortgage?

An HMO mortgage is designed for properties where multiple tenants share common facilities such as kitchens or bathrooms. These mortgages are ideal for landlords investing in Houses in Multiple Occupation (HMOs), which often generate higher rental yields than standard buy-to-let properties.

Larger HMOs—those accommodating five or more tenants—may require additional licensing from local authorities. These properties must comply with stringent safety and regulatory standards to ensure tenant well-being.

Why Choose an HMO Mortgage?

Here are some reasons landlords prefer portfolio mortgages over standard buy-to-let products:

Higher Rental Returns

MOs typically yield higher rental income than single-tenancy properties, as landlords can charge rent per individual tenant.

Risk Management

With multiple tenants, the loss of a single renter has minimal impact on total rental income, helping to reduce financial risk.

Tax Efficiency

Landlords using a limited company structure can access tax benefits, including the ability to offset mortgage interest payments as business expenses.

Expenses Involved in HMO Mortgages

Factors Affecting HMO Mortgage Interest Rates

•Property Size – Larger HMOs may come with slightly higher interest rates.

•Rental Yields – Strong rental yields can lead to more favorable mortgage terms.

•Loan-to-Value (LTV) Ratio – Lower LTVs generally attract better interest rates.

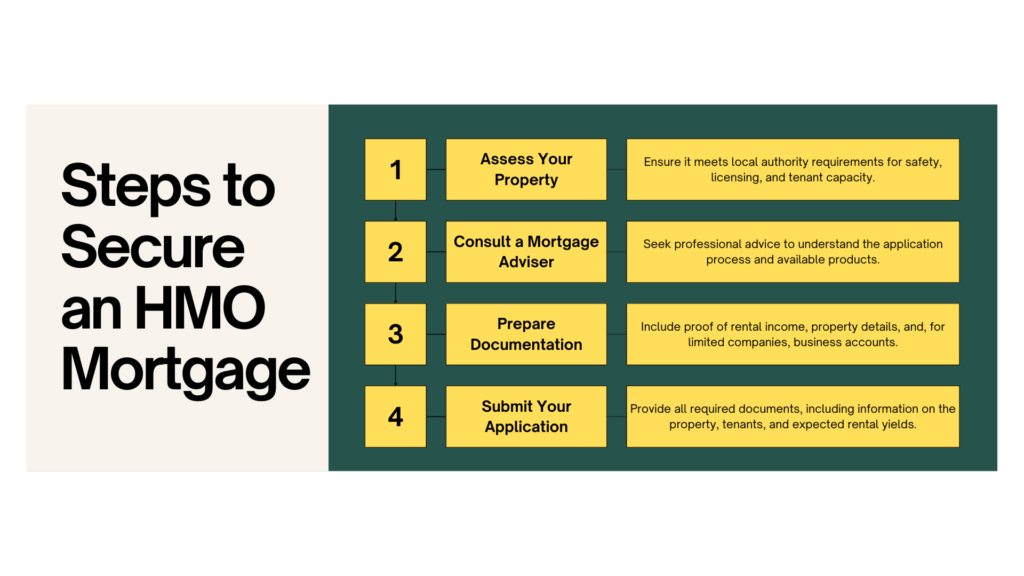

Working with an experienced mortgage broker can help you find competitive HMO mortgage rates suited to your specific needs.

HMO Mortgage Rates

Factors Influencing HMO Mortgage Interest Rates

• Property Size – Larger HMOs may come with slightly higher interest rates.

• Rental Yields – Higher rental income potential can lead to more favourable mortgage terms.

• Loan-to-Value (LTV) Ratio – Lower LTVs generally secure better interest rates.

Working with an experienced mortgage broker can help you find competitive HMO mortgage rates tailored to your financial situation.

Frequently Asked Questions

What is an HMO property?

An HMO is a property rented out to three or more tenants from different households who share common facilities.

Are HMO mortgage rates higher than standard buy-to-let rates?

Yes, HMO mortgage rates are typically higher due to the additional complexity and perceived risk.

Can first-time buyers apply for HMO mortgages?

A: First-time landlords may qualify, but they often need higher deposits and meet stricter lending criteria.

How does the licensing process affect HMO mortgage applications?

Properties must comply with local licensing requirements, which lenders assess before approving a mortgage.

What are the benefits of managing HMOs through a limited company?

Limited companies can offer tax advantages, such as deducting mortgage interest payments, and may simplify portfolio management.

Why Choose Compare the Mortgage for Your HMO Mortgage?

At Compare the Mortgage, we specialise in securing the best HMO mortgage solutions for landlords. Here’s how we can help:

Expert Advice

Expert advice on managing HMOs, from standard rentals to large, licensed properties.

Wide Lender Network

Direct access to lenders with competitive rates and flexible mortgage terms.

Tailored Solutions

Tailored mortgage solutions for first-time landlords, seasoned investors, and limited companies.

Transparent Costs

Transparent breakdowns of application fees, interest rates, and associated costs.

Get Started Today

Whether you’re purchasing your first HMO or expanding your portfolio, we’re here to help. Contact Compare the Mortgage today to explore HMO mortgage options tailored to your needs.