Holiday Let Mortgages: A Complete Guide

Investing in a holiday let property offers a great opportunity to generate income while enjoying personal getaways. Whether you’re considering a holiday let mortgage, a buy-to-let holiday home mortgage, or looking for the best holiday let mortgage rates, understanding your options is key to making a well-informed decision.

What Is a Holiday Let Mortgage?

A holiday let mortgage is a specialised loan designed for properties rented out as short-term holiday accommodations. Unlike buy-to-let mortgages, which cater to long-term tenants, these mortgages consider the seasonal income fluctuations and management requirements of holiday rentals.

Key features of holiday let mortgages include:

•Increased Earnings Potential – Holiday lets can generate higher weekly rental income during peak seasons compared to traditional long-term rentals.

•Personal Use Flexibility – Many lenders permit owners to use the property for up to 90 days per year.

•Adaptability to Seasonal Income – These mortgages are structured to accommodate fluctuating rental income across high and low seasons.

Who Is Eligible for a Holiday Let Mortgage?

To qualify for a holiday let mortgage, you’ll need to meet specific lender requirements. Here’s what they typically assess:

Property Location and Suitability

The property should be in a sought-after holiday location and suitable for short-term rentals. Coastal areas, countryside retreats, and popular tourist destinations often meet these criteria.

Financial Stability

A strong credit score and proof of income are essential. Lenders may also require a projected rental income report from a letting agent.

Experience in Property Management

Although not always required, prior experience as a landlord or property manager can enhance your application.

Minimum Rental Income

Lenders typically set a minimum rental income threshold based on the property’s projected earnings.

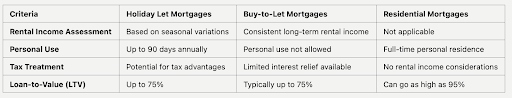

Holiday Let Mortgages vs. Buy-to-Let Mortgages vs. Residential Mortgages: Key Differences

Although they share some similarities, multi-unit freehold block mortgages differ from HMO mortgages.

Benefits of Holiday Let Mortgages

•Higher Rental Yields – Holiday lets can generate higher weekly rents during peak seasons, offering greater profitability compared to standard buy-to-let properties.

•Tax Benefits – Holiday let properties may qualify for several tax advantages:

•Mortgage interest can be deducted from rental income.

•Furnished holiday lets (FHLs) may benefit from capital gains tax relief.

•Rental income counts as earned income, contributing to pension eligibility.

•Flexibility & Personal Use – Enjoy personal holidays at your property while earning rental income when it’s let out.

•Portfolio Diversification – Investing in a holiday let helps spread risk and creates an additional income stream beyond traditional buy-to-let investments.

Expenses to Factor in for Holiday Let Mortgages

Before securing a buy-to-let holiday home mortgage, it’s essential to factor in all associated expenses:

•Interest Rates – Mortgage rates vary based on the lender and product type, with both fixed and variable rate options available.

•Arrangement & Application Fees – Lenders typically charge these fees to process your mortgage application.

•Valuation & Legal Fees – Upfront costs include property valuation fees and solicitor charges.

•Maintenance & Running Costs – Holiday lets require regular cleaning, furnishing, and upkeep to maintain guest standards.

•Insurance Costs – Specialist holiday let insurance is needed to cover risks associated with short-term rentals and potential void periods.

Holiday Let Mortgage Interest Rates

Factors Affecting Holiday Let Mortgage Rates

•Loan-to-Value (LTV) – Lower LTV ratios typically lead to more competitive interest rates.

•Rental Income Potential – Lenders evaluate the property’s projected rental income to determine affordability.

•Mortgage Type – Choose between interest-only mortgages for lower monthly payments or repayment mortgages to build equity over time.

Use our mortgage calculator to to work out the best holiday rate for your circumstances and needs

Frequently Asked Questions

What defines a holiday let property?

A holiday let is a furnished property rented to holidaymakers on a short-term basis. It must be available to let for at least 210 days a year and let for a minimum of 105 days annually.

Can I live in a holiday let property?

You can use it personally for up to 90 days a year, but it must primarily serve as a rental property.

Are holiday let mortgages available to first-time buyers?

While it’s less common, some lenders may consider first-time buyers with a strong financial profile.

What’s the difference between a holiday let and a holiday home?

A holiday let generates rental income, while a holiday home is for personal use only and often funded with a residential mortgage.

Why Choose Compare the Mortgage for Holiday Let Mortgages?

At Compare the Mortgage, we specialise in helping property investors find the best holiday let mortgages. Here’s why you should choose us:

Extensive Lender Network

We offer access to competitive mortgage deals from leading lenders.

Expert Guidance

Our team provides personalised guidance to align with your investment objectives.

Simple Application Process

We manage the complexities of securing a mortgage, simplifying the process and saving you time.

Transparent Fees

We offer transparent details on all costs, including interest rates and fees.

Start Your Holiday Let Investment Today

Whether you’re buying your first holiday let or expanding your portfolio, our experts are here to assist. Contact Compare the Mortgage today to explore tailored mortgage solutions for your next investment.