Limited Company Buy-to-Let Mortgages: A Comprehensive Guide

Limited company buy-to-let mortgages are a popular choice for landlords seeking tax efficiency and portfolio growth. Investing through a limited company can provide potential tax advantages and increased flexibility, making it an appealing option for many property investors.

Understanding how these mortgages work, the eligibility criteria, and the associated costs is essential for determining whether this strategy aligns with your investment goals.

Understanding Limited Company Buy-to-Let Mortgages

A limited company buy-to-let mortgage is a loan tailored for properties owned by a company rather than an individual. Many landlords establish a Special Purpose Vehicle (SPV)—a company dedicated to property investment—to streamline mortgage applications and potentially enhance tax efficiency.

This structure can provide greater financial flexibility, access to a broader range of lenders, and potential tax advantages, depending on your investment strategy.

Essential Features of Limited Company Buy-to-Let Mortgages

• Interest Rates – These mortgages often come with slightly higher interest rates than personal buy-to-let loans. However, potential tax benefits can help offset the cost. Both fixed and variable rate options are available.

• Loan Terms – Typically ranging from 5 to 30 years, mortgage terms depend on factors such as the company’s financial stability, projected rental income, and repayment strategy.

• Deposit Requirements – Most lenders require a minimum deposit of 25%, though a larger deposit may help secure better rates and terms.

• Eligibility Criteria – Lenders evaluate the company’s credit history, the financial standing of its directors, and the property’s expected rental income. Many also require personal guarantees, especially for newly established SPVs.

Why Use a Limited Company for Your Buy-to-Let Investment?

Tax Efficiency

Limited companies can deduct mortgage interest payments as business expenses, reducing their corporation tax liability. This provides a significant advantage over personal buy-to-let investments, where mortgage interest tax relief is more limited.

Portfolio Growth

For portfolio landlords, managing multiple properties within a company structure can simplify financial administration and improve efficiency.

Succession Planning

Transferring company shares is usually easier and more tax-efficient than transferring property ownership directly.

Enhanced Borrowing Options

Lenders often use more favorable stress rate assessments for SPVs, which can increase borrowing capacity.

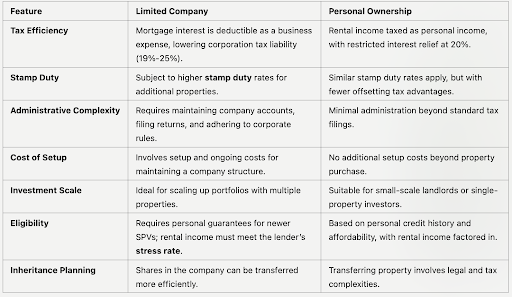

Limited Company vs. Personal Buy-to-Let Mortgages

Here’s a comparison of the two approaches:

Costs to Consider

When evaluating limited company buy-to-let mortgages, it’s important to factor in all associated expenses:

• Interest Rates – Typically range between 3% and 6% annually, depending on the lender and loan terms.

• Stamp Duty – Additional property purchases are subject to higher stamp duty rates, which should be considered in your investment strategy.

• Arrangement Fees – Lenders charge setup fees, usually between 1% and 10% of the loan amount.

• Valuation Fees – A professional valuation determines the property’s market value, influencing loan terms.

• Legal & Administrative Costs – Includes legal fees for mortgage setup and ongoing company filing expenses.

• Broker Fee – At Compare the Mortgage, our fee is tailored to your circumstances, ensuring expert guidance and a mortgage solution that fits your needs.

Steps to Securing a Limited Company Buy-to-Let Mortgage

1. Set Up a Special Purpose Vehicle (SPV) – Register your company with the appropriate SIC codes (68100 or 68209) to classify it as a property investment business.

2. Consult a Mortgage Broker – Work with a specialist broker experienced in limited company buy-to-let mortgages to find the best deals and navigate lender criteria.

3. Prepare Essential Documents – Gather key paperwork, including rental income projections, company financial records, and identification, to ensure a smooth application process.

4. Submit Your Application – With your broker’s assistance, complete and submit the application accurately to prevent delays and improve approval chances.

Effective Strategies for Maximising Success with Limited Company Buy-to-Let Mortgages

• Compare Mortgage Deals – Evaluate products from multiple lenders to find the best fit for your investment strategy. Consider the total cost, including fees and interest rates, rather than just the headline rate.

• Understand Stress Testing – Lenders assess whether rental income sufficiently covers mortgage payments. Understanding these calculations can help you structure your finances more effectively.

• Seek Professional Tax Advice – Consult a tax expert to fully understand the implications of owning property through a limited company and optimise any potential tax benefits.

• Keep Strong Financial Records – Maintaining clear, well-organised financial records can improve your eligibility for favourable mortgage terms and streamline the application process.

Why Choose Compare the Mortgage for Limited Company Mortgages?

At Compare the Mortgage, we specialise in buy-to-let mortgages for limited companies. Here’s what makes us stand out:

Tailored Solutions

We offer tailored mortgage solutions designed to match your investment goals.

Expert Guidance

Our team has in-depth expertise in handling the complexities of limited company mortgage structures.

Wide Lender Network

Gain access to competitive rates from both high-street banks and specialist lenders.

Transparent Costs

We provide clear guidance on all costs, from arrangement fees to ongoing administrative expenses.

Start Your Buy-to-Let Journey Today

Whether you’re a seasoned landlord or new to property investment, a limited company buy-to-let mortgage can help you grow a profitable portfolio. Contact Compare the Mortgage today to explore your options and secure the best mortgage deals available.