Foreign National Mortgages: A Complete Guide to Investing in UK Property

Navigating the UK mortgage market as a foreign national can be challenging, but with the right support, it’s entirely possible. Whether you’re purchasing a home or investing in buy-to-let property, understanding the key aspects of foreign national mortgages in the UK is essential.

What Is a Foreign National Mortgage?

A foreign national mortgage is a tailored loan for individuals without UK citizenship or permanent residency who wish to buy property in the UK. These mortgages accommodate a range of applicants, including those on work visas, EU nationals, and overseas residents.

Essential Features of Foreign National Mortgages

Key Features of Foreign National Mortgages

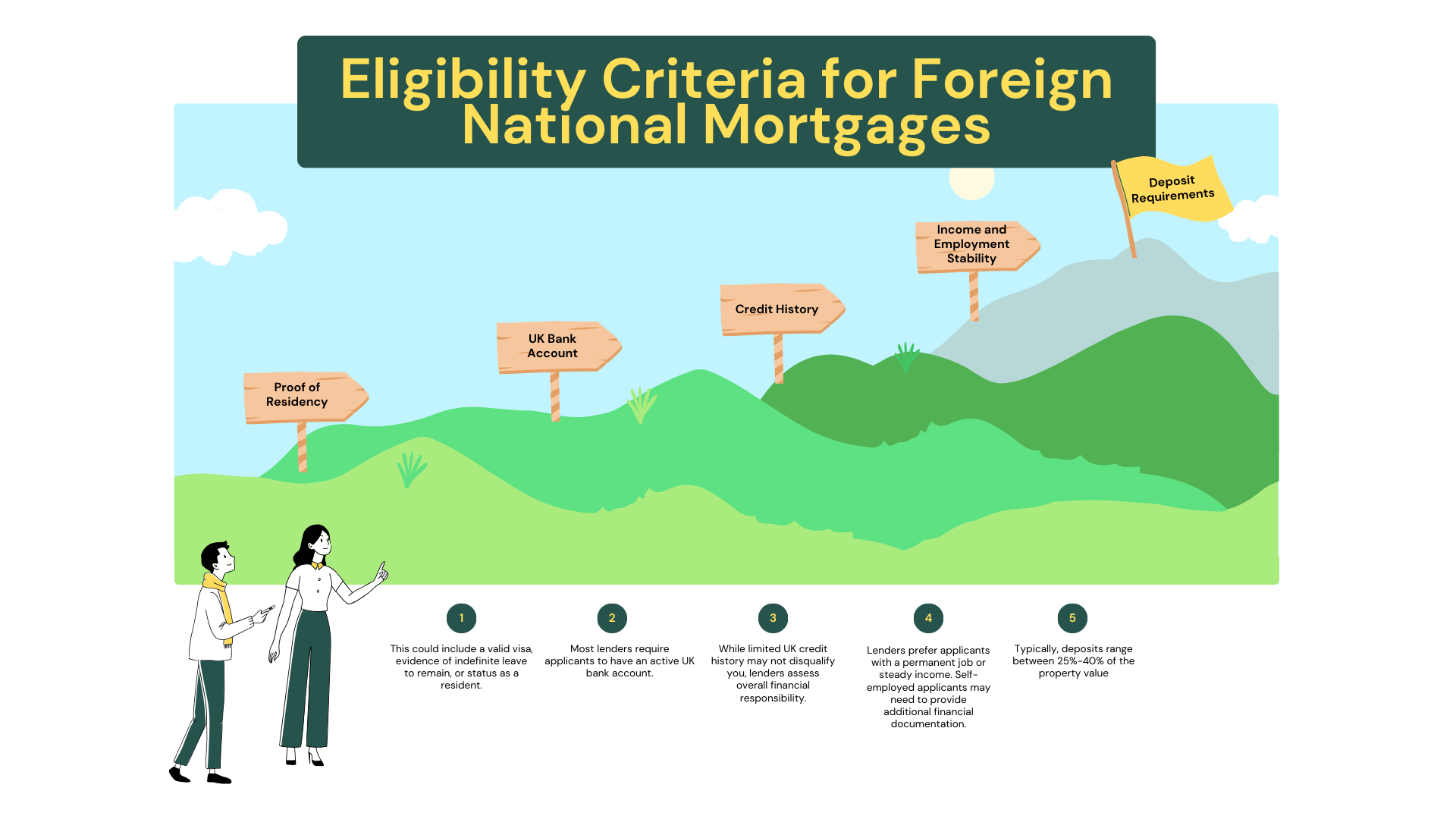

• Eligibility Criteria – Suitable for non-residents, UK residents with limited credit history, and individuals on work visas. Mortgage options are often available for those with indefinite leave to remain or specific residency statuses.

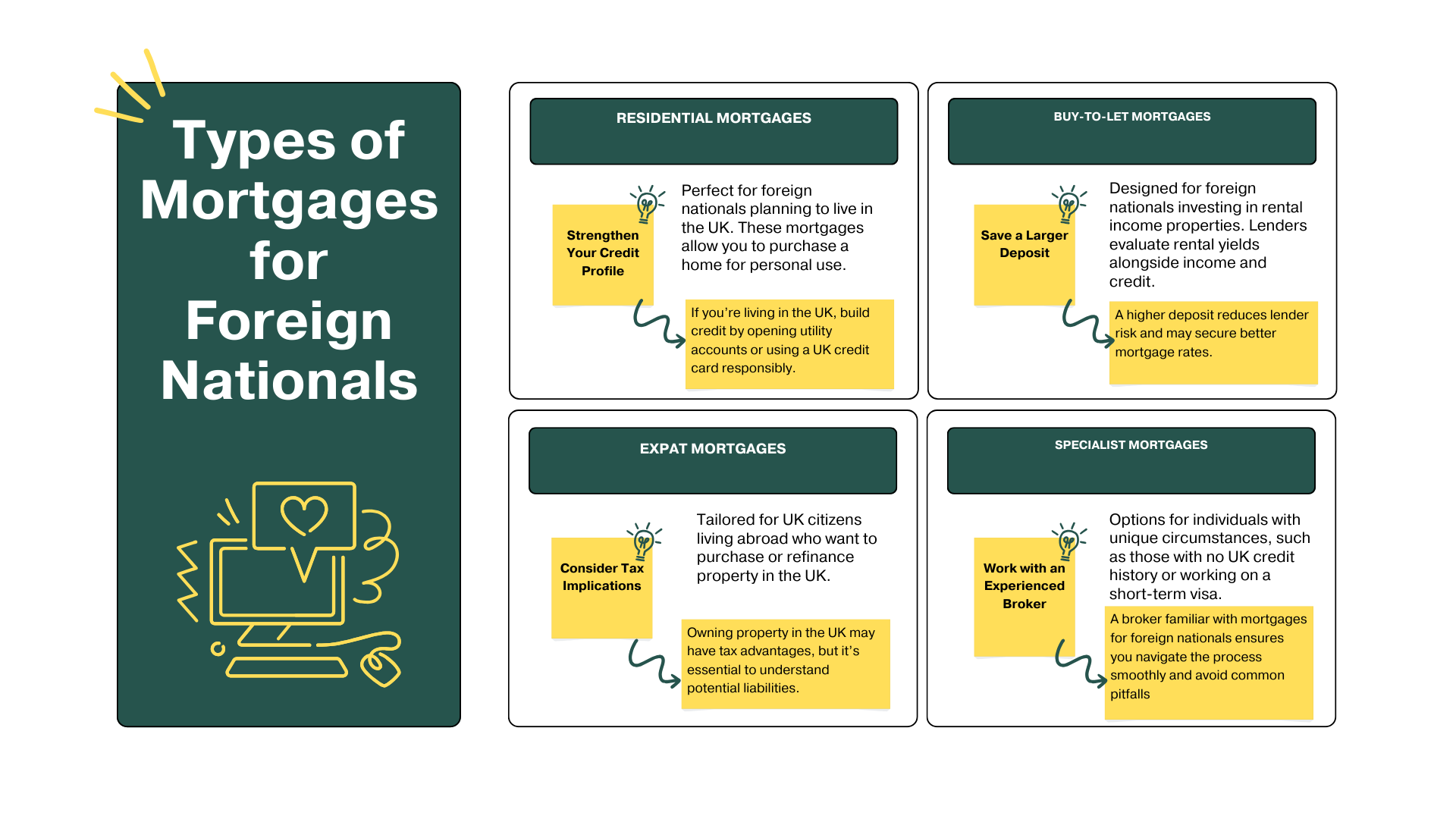

• Diverse Property Options – Whether purchasing a residential home, an investment property, or a buy-to-let mortgage for foreign nationals, lenders offer tailored solutions to meet different needs.

• Interest Rates & Loan Terms – Rates depend on factors such as credit history, deposit amount, and income stability. Both fixed-rate and variable-rate mortgage options are available.

What Are the Benefits of a Foreign National Mortgage?

Buying property in the UK provides stability and potential financial growth. A foreign national mortgage allows access to opportunities such as:

Buying a Home While Living and Working in the UK

If you’re residing in the UK on a visa or with stable employment, securing a mortgage enables you to establish roots and build equity in your property.

Investing in Buy-to-Let Properties

For those seeking to earn rental income, a buy-to-let mortgage designed for foreign nationals provides a great investment opportunity.

Leveraging International Opportunities

Even if you live abroad, these mortgages allow you to invest in the UK’s strong and stable property market.

How to Apply for a Foreign National Mortgage

1. Consult a Mortgage Broker – Work with a specialist in foreign national mortgages who can connect you with lenders that cater to your specific circumstances.

2. Prepare Your Documents – Gather key paperwork, including:

• Proof of ID and address

• Income verification (payslips or tax returns)

• Details of your current residency status

3. Use Mortgage Calculators – Online tools can help estimate how much you can borrow and what your monthly repayments may be based on your income and deposit.

4. Submit Your Mortgage Application – Your broker will guide you through the application process, ensuring all requirements are met for a smooth approval.

Advantages of Using a Mortgage Broker

Why Work with a Foreign National Mortgage Broker?

A specialist mortgage advisor simplifies the process by offering:

• Access to Specialist Lenders – Not all UK banks offer mortgages to foreign nationals, but brokers can connect you with the right lenders.

• Expert Guidance – Brokers understand the complexities and challenges of securing a mortgage as a foreign national.

• Tailored Solutions – Mortgage options customised to suit your residency status, financial situation, and property investment goals.

Frequently Asked Questions

Can foreign nationals apply for buy-to-let mortgages?

Yes, many lenders offer buy-to-let mortgages for foreign nationals, provided eligibility criteria like income and deposit requirements are met.

What deposit is required?

Deposits typically range from 25%-40% of the property value, depending on the lender and your circumstances.

Can I get a mortgage without a UK credit history?

Some lenders accommodate foreign nationals with limited UK credit history by assessing international financial records.

Are interest rates higher for foreign nationals?

Interest rates may be slightly higher to account for additional risk but vary depending on your financial profile.

Do I need a UK bank account?

Yes, most lenders require a UK bank account to process mortgage payments.

Why Choose Compare the Mortgage?

At Compare the Mortgage, we specialise in helping foreign nationals find the right mortgage. Here’s how we can assist you:

Tailored Solutions

Personalised advice tailored to your specific residency and financial circumstances.

Wide Network

Access to expert lenders offering competitive rates.

Simplified Process

We take care of the paperwork, saving you time and reducing stress.

Transparency

Transparent explanations of fees, interest rates, and repayment terms.

Start Your Mortgage Journey Today

Whether you’re purchasing your first home, investing in rental properties, or refinancing, we’re here to assist. Contact Compare the Mortgage today to explore the best foreign national mortgage options in the UK for your needs.