Multi-Unit Freehold Block Mortgages: Your Complete Guide

A multi-unit freehold block (MUFB) mortgage is a specialised financing option for landlords and property investors who own multiple self-contained units under a single freehold title. Whether you’re new to multi-unit investments or seeking to refinance, these mortgages can streamline property management and maximise rental returns.

Understanding Multi-Unit Freehold Block Mortgages

A multi-unit freehold block (MUFB) mortgage is designed for properties comprising multiple self-contained units—such as flats, studios, or apartments—held under a single freehold title. This type of financing offers flexibility and convenience, making it ideal for property investors managing multiple tenants, including those in units with shared facilities like kitchens and bathrooms.

Essential Features of Multi-Unit Freehold Block Mortgages

•Simplified Financing – Manage all units within a single property under one mortgage, streamlining your financial structure.

•Property Flexibility – Suitable for various property types, including buy-to-let investments, converted houses, and blocks of flats.

•Enhanced Rental Income – Multi-unit properties often generate higher rental yields, reducing the financial impact of void periods.

•Flexible Lending Criteria – Lenders assess the total rental income from all units, improving mortgage eligibility.

•Customisable Interest Rates – Choose between fixed or variable rates based on your financial strategy, with terms influenced by property type, borrower profile, and loan amount.

Advantages of Multi-Unit Freehold Block Mortgages

Here are some reasons landlords prefer portfolio mortgages over standard buy-to-let products:

Simplified Management

Handle a single mortgage instead of separate loans for each unit, simplifying paperwork and reducing administrative hassle.

Enhanced Borrowing Power

Lenders typically evaluate the property’s overall income rather than the profitability of individual units, allowing for higher loan amounts.

Tax Efficiency

For properties held within a limited company, these mortgages can provide tax benefits, including the ability to offset interest expenses against profits.

Higher ROI

With multiple tenants providing steady rental income, these properties are well-suited for building a profitable investment portfolio.

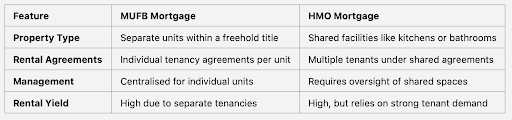

Multi-Unit Freehold Block Mortgages vs. HMO Mortgages

Although they share some similarities, multi-unit freehold block mortgages are distinct from HMO mortgages.

Why Choose Compare the Mortgage?

At Compare the Mortgage, we specialise in multi-unit freehold block mortgages, offering tailored solutions for property investors. Here’s why clients choose us:

Wide Lender Network

Direct access to competitive rates from both high street and specialist lenders.

Expert Guidance

Full guidance throughout the mortgage application process, ensuring all requirements are met smoothly.

Tailored Solutions

Versatile mortgage solutions for mixed-use properties, large MUFBs, and limited company ownership.

Transparent Fees

Transparent cost breakdown, covering application and valuation fees.

Frequently Asked Questions

What properties qualify for a MUFB mortgage?

Properties with multiple self-contained units under one freehold title, such as blocks of flats or converted houses.

Can I apply through a limited company?

Yes, many lenders offer multi-unit mortgages tailored to limited companies.

How do lenders assess rental income?

Lenders evaluate the total rental yields across all units to determine affordability.

Are interest rates higher for multi-unit properties?

Rates may vary based on the property type and lender criteria, but they are often competitive with buy-to-let mortgage rates.

What is the maximum LTV for a MUFB mortgage?

Most lenders offer up to 75% LTV, though some may provide higher ratios for certain property types.

Start Your Multi-Unit Investment Journey

Whether you’re purchasing your first multi-unit property or growing your portfolio, Compare the Mortgage is here to help. Contact us today for expert guidance and tailored mortgage solutions.