Bridging Loan: A Flexible Option for Short-Term Financing

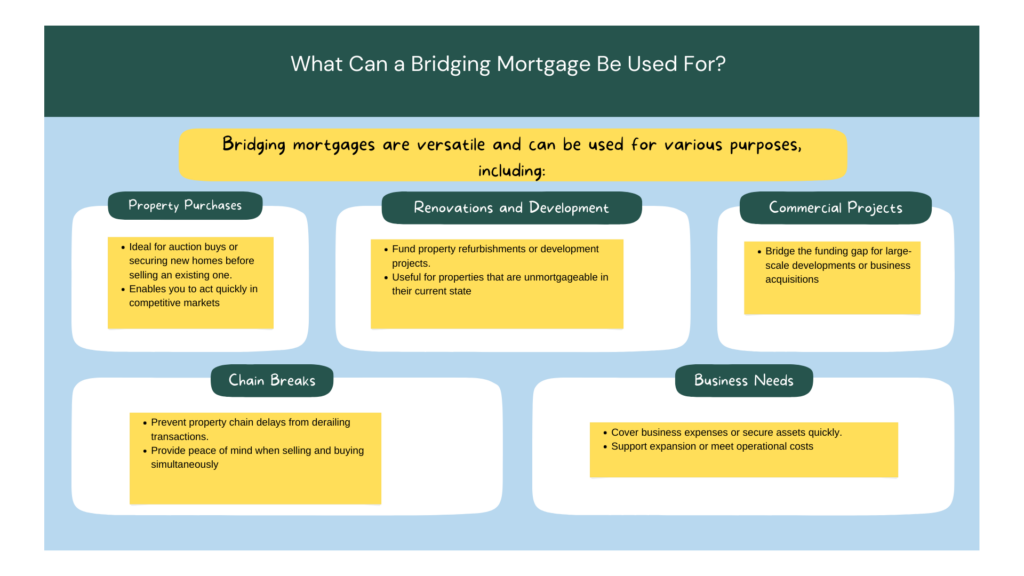

When you require quick funding, a bridging mortgage offers a fast and flexible solution. Perfect for bridging financial gaps during property transactions or renovations, these short-term loans provide greater flexibility than traditional mortgages. Whether you’re a homeowner, investor, or property developer, understanding how bridging mortgages work can empower you to make well-informed choices.

What Is a Bridging Mortgage?

A bridging mortgage is a short-term loan designed to help borrowers “bridge the gap” between purchasing a new property and securing long-term financing or selling an existing asset. These loans are usually secured against a property and can be used for both residential and commercial purposes.

Essential Features of Bridging Mortgages

Key Features of Bridging Mortgages

• Fast Access to Funds – Bridging loans can be arranged in as little as 7-14 days.

• Short Loan Duration – Typically between 1 and 12 months, with some loans extending up to 36 months.

• Higher Loan-to-Value (LTV) – Borrow up to 75% or more of the property’s value.

• Flexible Repayment Options – Repayment methods include selling the property, refinancing, or other exit strategies.

How a Bridging Mortgage Works

A bridging mortgage offers quick funding while you secure long-term financing or finalise a property transaction. Here’s an example:

Scenario

ou buy a property at auction for £500,000 but need to finalise the transaction within 28 days.

Solution

Obtain a bridging mortgage for £375,000 (75% LTV) to finance the purchase while you await the sale of your existing property.

Exit Strategy

Once your current property is sold, you use the proceeds to repay the bridging loan, along with any interest and fees.

Bridging loans are commonly used in time-sensitive situations, allowing you to act as a cash buyer. This makes them especially appealing for property auctions or when a property chain breaks.

Expenses Associated with a Bridging Mortgage

Bridging mortgages can be more expensive than traditional loans due to their short-term nature and higher risk. It’s important to be aware of the following costs:

• Interest Rates

Rates range from 0.4% to 1.5% per month (equivalent to 5% to 18% APR or higher).

Example: A £300,000 loan at 1% monthly interest would cost £3,000 per month.

• Fees

• Arrangement Fees: Typically 1%-2% of the loan amount.

• Valuation Fees: Property assessment fees, usually a few hundred pounds.

• Exit Fees: Charged when the loan is repaid.

• Legal and Administrative Fees: Covers contract setup and other related formalities.

Qualification Requirements

Eligibility Criteria for Bridging Loans

Although bridging loans are more accessible than traditional mortgages, lenders still evaluate applications based on the following factors:

• Credit History – While not as crucial as for standard mortgages, a good credit score can help secure better rates.

• Property Value – The loan amount is based on the value of the property being used as collateral.

• Exit Strategy – A clear and feasible plan to repay the loan, such as through property sale or refinancing.

• Deposit/Equity – Borrowers typically need at least 25% equity in the property.

• Income Assessment – Lenders may assess your ability to cover interest payments, especially for longer-term loans.

Benefits of Bridging Mortgages

• Quick Processing – Funds can be accessed within days, making them ideal for time-sensitive transactions.

• Versatile Uses – Suitable for residential, commercial, and development projects.

• No Monthly Payments – Many lenders offer rolled-up interest, which is repaid at the end of the loan term.

• Large Loan Amounts – Borrow substantial sums based on the property’s value and equity.

• Customizable Terms – Flexible repayment options and loan durations tailored to your needs.

Potential Risks and Key Considerations

• Higher Interest Rates – Monthly interest charges can accumulate quickly, making it an expensive option.

• Risk of Repossession – Failing to repay the loan can lead to the sale of the secured property.

• Complex Fees – Arrangement, valuation, and exit fees can substantially increase the total cost.

• Uncertain Exit Strategies – Delays in property sales or refinancing can lead to higher costs.

Frequently Asked Questions

Can I get a bridging mortgage with bad credit?

Yes, some lenders specialise in bad credit bridging loans, but rates may be higher.

How does a bridging loan compare to a mortgage?

A bridging loan is short-term and designed for immediate funding needs, while a mortgage is long-term financing for property purchases.

What is the minimum deposit for a bridging mortgage?

Typically, you’ll need at least 25% of the property’s value as a deposit.

How are bridging loans repaid?

Most are repaid as a lump sum at the end of the term, often through property sale or refinancing.

Are bridging loans regulated?

Regulated bridging loans are overseen by the Financial Conduct Authority (FCA), while unregulated loans are not. Always check with your broker.

Why Choose Compare the Mortgage for Bridging Mortgages?

At Compare the Mortgage, we specialise in offering customised bridging mortgage solutions. Here’s what makes us stand out:

Expert Advice

Our team ensures you are fully informed about all costs, terms, and potential risks.

Wide Lender Network

Gain access to competitive offers from reliable lenders.

Speedy Approvals

Funds can be available in as little as 7 days.

Transparent Fees

Transparent breakdown of all costs, including interest and arrangement fees.

Bespoke Solutions

Customised financing designed to meet your specific needs and exit strategy.

Start Your Bridging Mortgage Journey Today

Ready to bridge the gap? Contact Compare the Mortgage today to explore your options and secure fast, flexible financing tailored to your requirements.